This framework was first circulated to FundsIndia shoppers on 01-Mar-24, as we exited from our Small Cap Tactical name

Are Small caps in a bubble?

Right here is our 6 lens framework (Worth Cycle – Lengthy & Quick, Valuations, Flows & Sentiments, Earnings Progress Surroundings, Previous Returns) to judge the place we’re within the small cap cycle.

As a substitute of taking a unidimensional view, the try is to view the small cap cycle from 6 completely different vantage factors to determine the ‘elephant’!

What qualifies as a ‘Bubble’ in small caps?

The valuations are so excessive that even after a 25% correction, it will nonetheless stay costly and doesn’t make sense to enter!

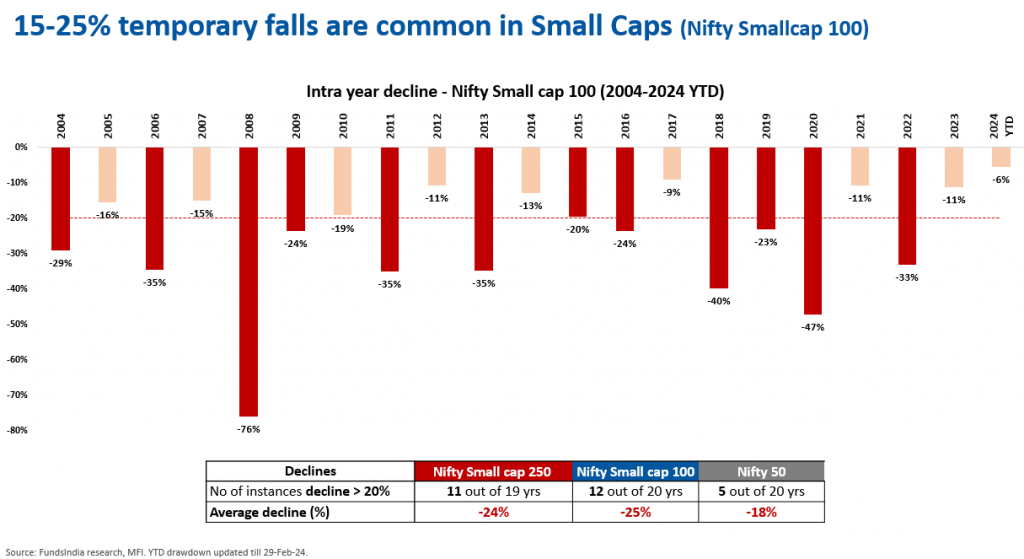

Why 25% correction?

6 Lens Framework to Analyse Small Cap Phase

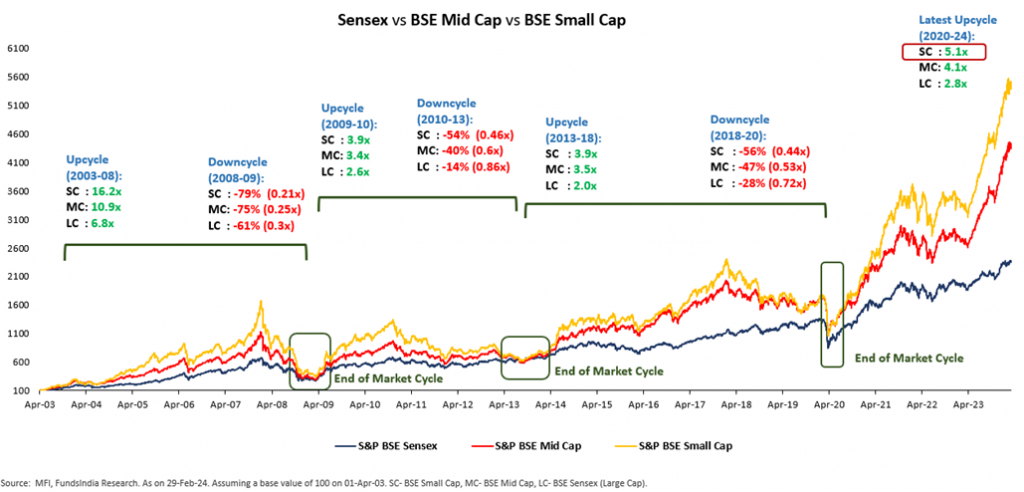

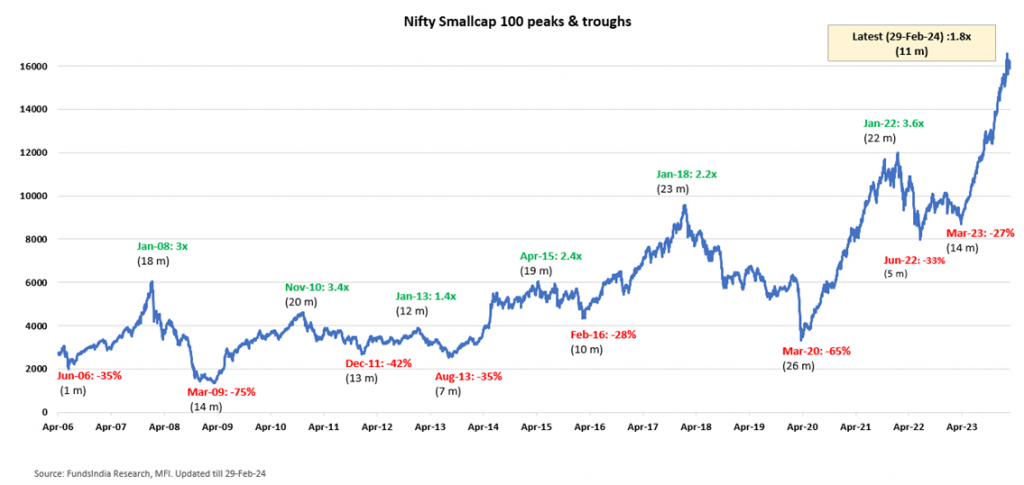

LENS 1 – LONG PRICE CYCLE: Lengthy Cycle Indicator is flashing ‘purple’ – near historic highs

Small Cap Worth Cycle – Present rally at 5.1x instances from 2020 lows

Massive, Mid & Small Caps are likely to converge over lengthy cycles, however small caps do disproportionately properly in upcycles and vice versa. Presently, Small Caps have seen a pointy rally of 5.1x from the bottoms in Mar-2020.

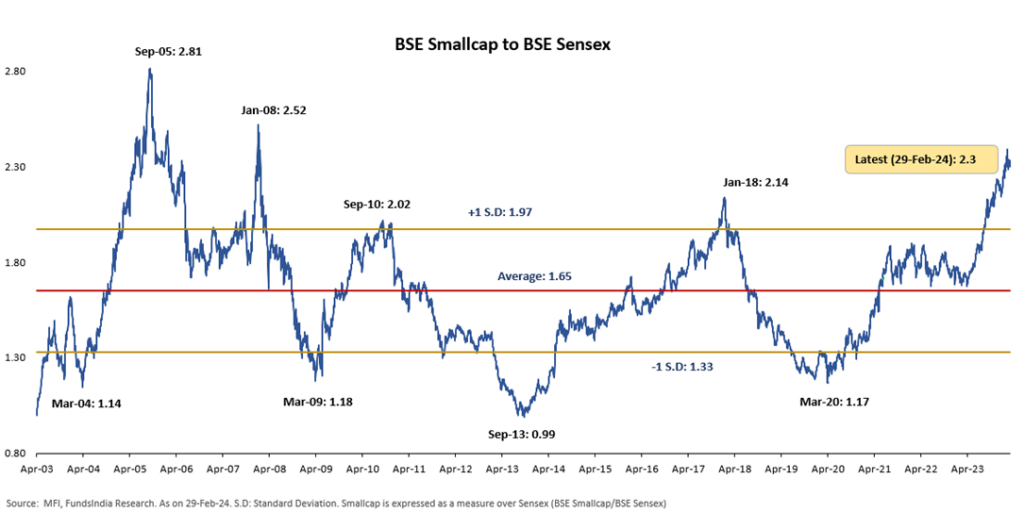

BSE Small Cap to BSE Sensex ratio near 16 12 months highs

Traditionally each time this ratio has crossed 2.0x the small caps phase has fallen within the quick time period. Small Cap to Massive Cap ratio (at the moment at 2.3x) has crossed 2018 peak ranges and is transferring nearer to 2008 peaks indicating ‘excessive danger’. This necessitates warning on the present juncture.

LENS 2 – SHORT PRICE CYCLE: Rally could proceed for some extra time (6-12 months)

Up to now cycles, common time from the underside to peak is ~1.5 to 2 years and common upside is ~2-3x.

Present rally is at 11 months with 1.8x returns indicating scope for additional rally. Utilizing historical past as a information, quick worth cycle signifies that the rally could proceed for 6-12 months.

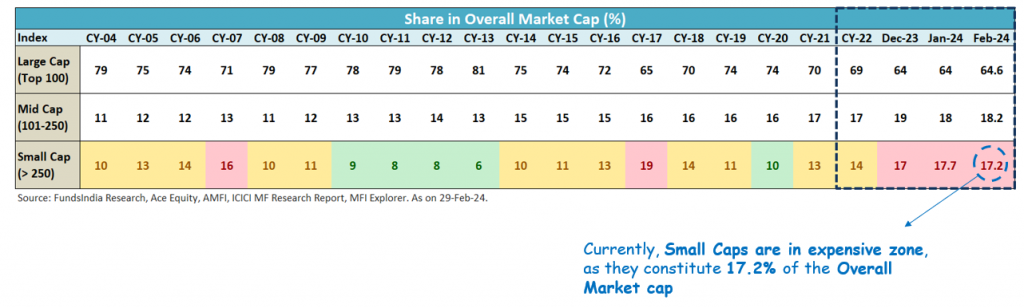

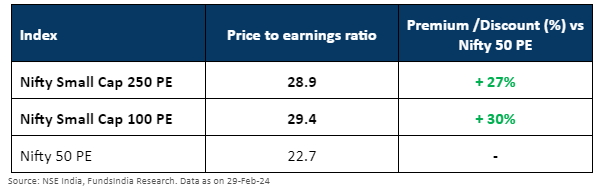

LENS 3 – VALUATIONS: Valuations have grow to be “Costly”

Share of Small Cap Market Capitalisation within the Total Market Capitalisation is at larger ranges (~17.2%).

At any time when the share of Small Cap MCAP within the Total MCAP crosses 15%, it warrants warning. Presently the share is at 17.2%. The revenue share of Small Caps within the Total Market remains to be at decrease ranges (~12%) as in comparison with the share of Market Cap.

Small Caps are at the moment buying and selling at a big premium over Massive Caps

Worth to Earnings of Small Cap Indices are buying and selling at traditionally larger premiums over Massive Caps. The present premium of Nifty Small Cap 250 PE vs Nifty 50 PE is at 27%, indicating costly valuations.

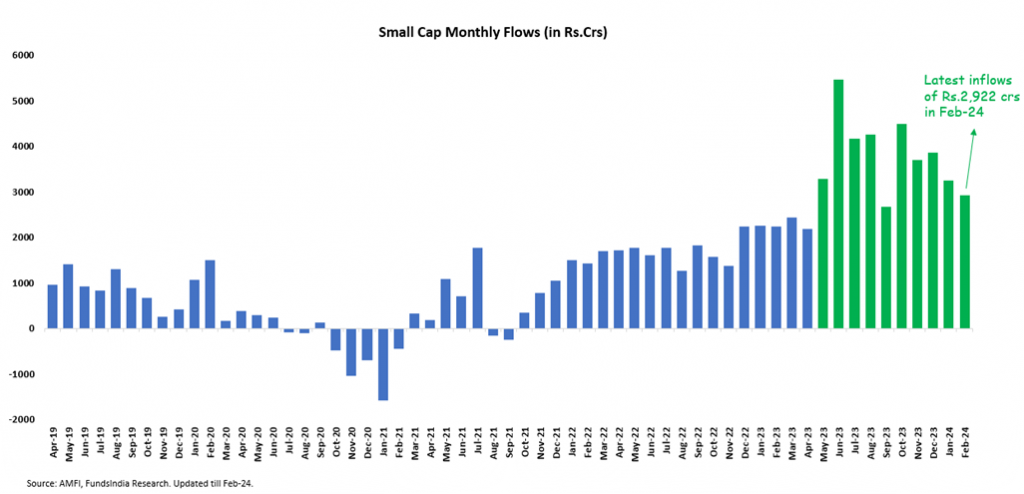

LENS 4 – SENTIMENTS & FLOWS – Sentiments point out ‘Greed’ within the Small Cap house

There was a big leap in Small Cap inflows and an growing variety of new folios beginning Might-23.

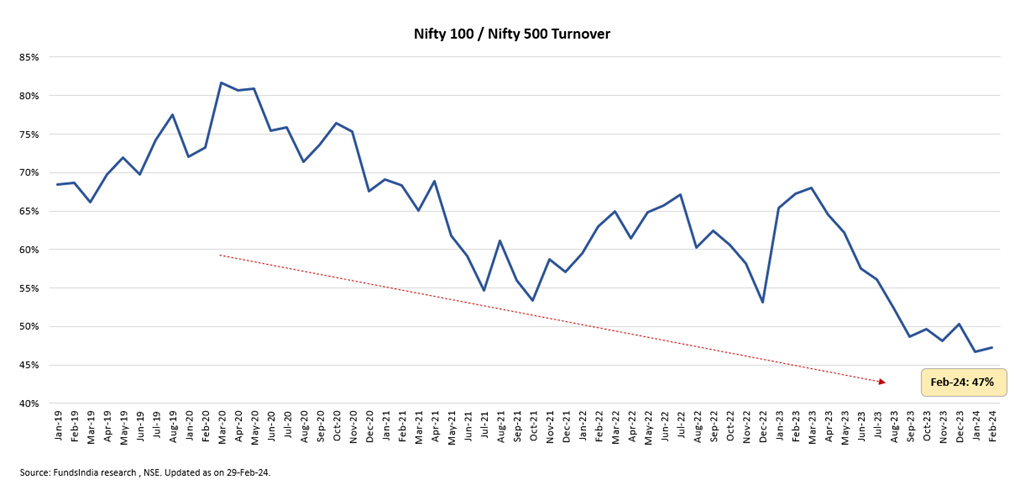

Nifty 100 Buying and selling quantity as a % of Nifty 500 has decreased indicating ‘excessive danger taking’ sentiments

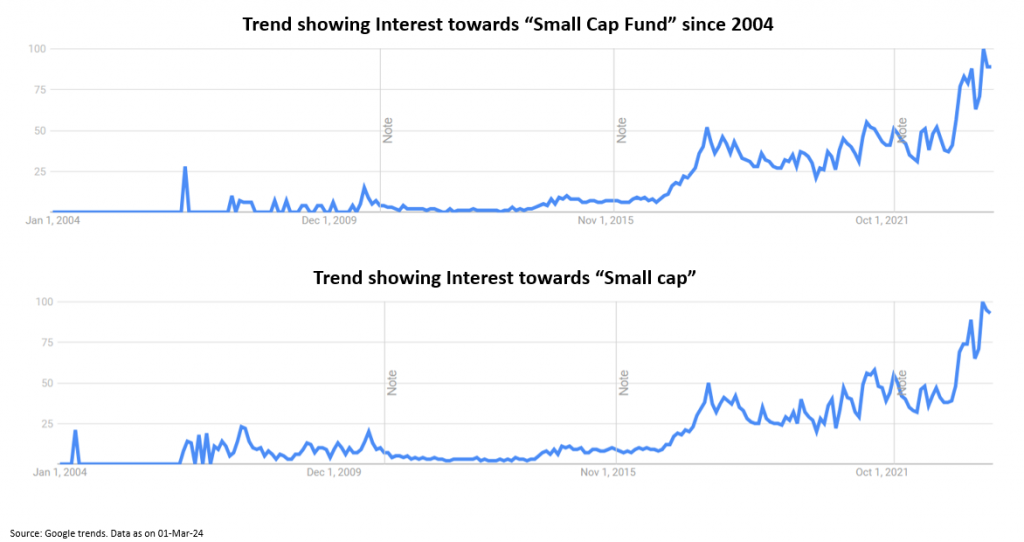

Google tendencies present vital Curiosity within the Small Cap house

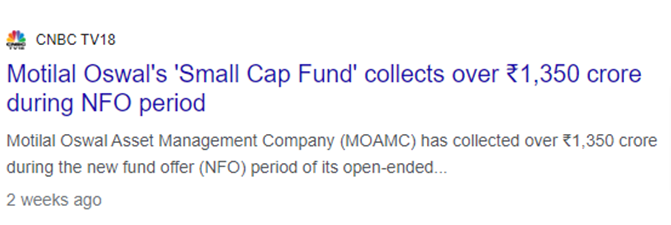

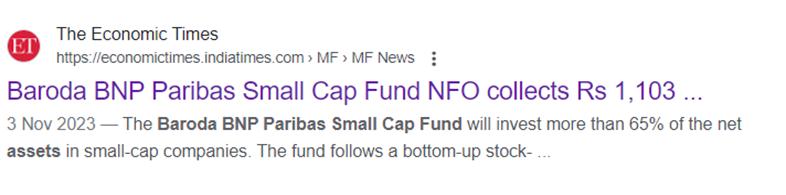

Lot of latest Small Cap Funds are getting launched and garnering excessive AUMs regardless of excessive valuations indicating excessive investor curiosity

Checklist of New Small Cap NFOs launched lately:

- Mirae Asset Nifty Smallcap 250 Momentum High quality 100 ETF Fund of Fund (15-Feb-24)

- Groww Nifty Smallcap 250 Index Fund (09-Feb-24)

- Bandhan Nifty Small Cap 250 Index Fund (12-Dec-23)

- Motilal Oswal Small Cap Fund (05-Dec-23)

- DSP Nifty Smallcap 250 High quality 50 Index fund (05-Dec-23)

- Quantum Small Cap Fund (16-Oct-23)

- Baroda BNP Paribas Small Cap Fund (06-Oct-23)

- Motilal Oswal Nifty Micro Cap 250 Index Fund (15-Jun-23)

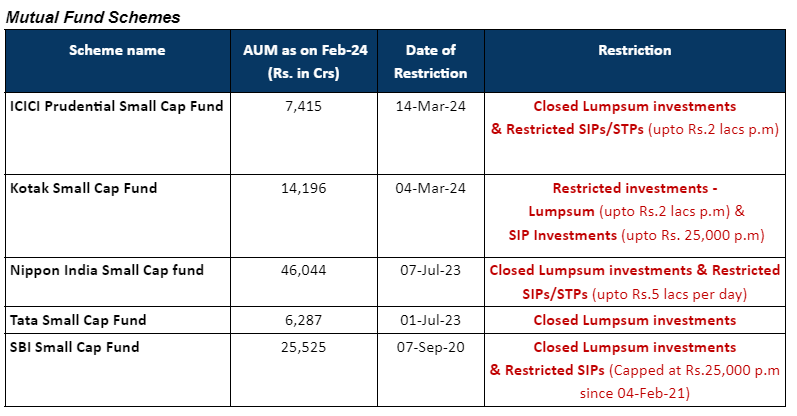

Whereas on the opposite aspect, some cautious Fund Managers have stopped accepting flows of their Small Cap Funds citing issues on Valuations and Flows

Mutual Funds regulator SEBI raised issues over “froth increase within the Small and Midcap phase” amid persevering with flows in these segments.

Trade physique Affiliation of Mutual Funds in India (AMFI) in a latest letter (dated 27-Feb-2024) has requested mutual funds to place in place safeguards to guard the pursuits of all traders in mid- and small-cap funds. AMFI despatched this letter after market regulator Securities and Trade Board of India (SEBI) raised issues of ‘froth increase in small and midcap segments’ amid persevering with flows in mid- and small-cap funds.

AMFI has suggested mutual funds to take “acceptable and proactive” measures corresponding to moderating inflows, portfolio rebalancing, conducting stress assessments on sharp redemption chance and so forth to defend traders from first-mover benefit of redeeming traders in case of sharp redemptions.

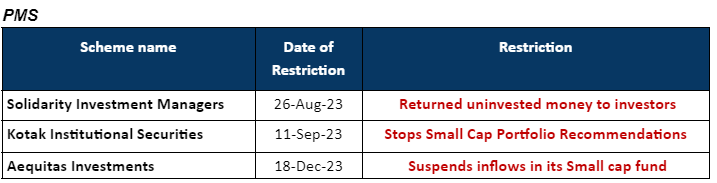

LENS 5 – PAST PERFORMANCE – Flashing “RED” Sign

Very Excessive Previous Efficiency – 1Y, 3Y, 5Y, 7Y and 10Y annual returns are much like previous Bubble markets -> Contra Indicator – indicating excessive optimism

- Throughout previous bubble markets, the final 1Y returns had been normally above 50%. Presently, the 1Y returns for Nifty Small Cap 100 TRI is at 75%.

- 3Y, 5Y and 7Y are within the 20-30% vary, which is analogous to 20-25% vary seen up to now bubbles.

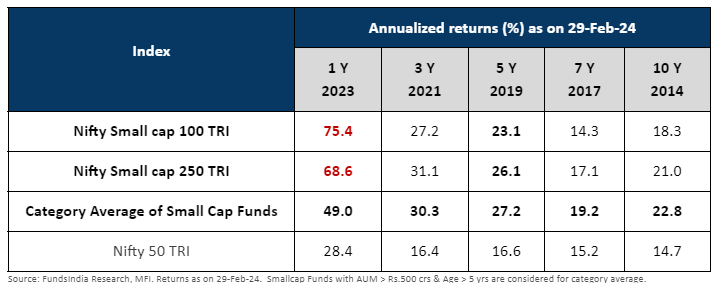

5Y Rolling return Outperformance of Small Caps vs Massive Caps are nearer to historic highs

The 5 12 months rolling outperformance of Nifty Small Cap 250 TRI vs Nifty 50 TRI is at 9.4% – nearer to 2018 peak ranges (11.4% outperformance vs Nifty 50 TRI).

LENS 6 – FUNDAMENTALS: Fundamentals are strong and market setting is beneficial for Small Caps

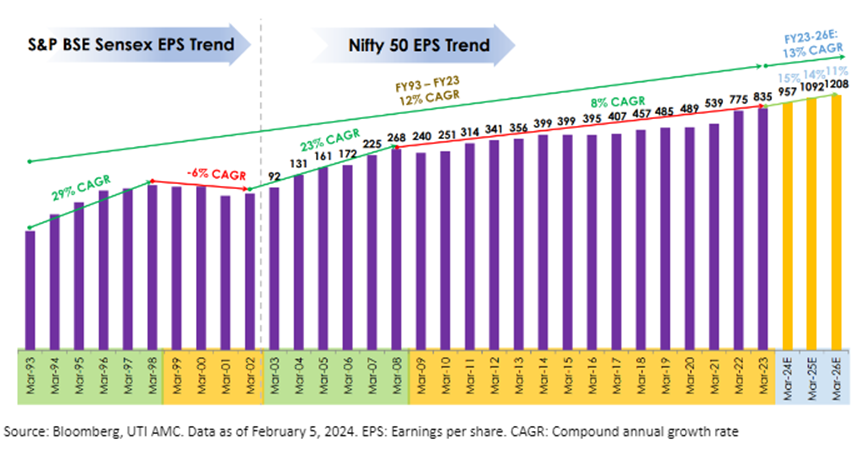

Broader markets anticipate sturdy earnings progress over the following 2-3 years. This augurs properly for Small Caps as they have an inclination to develop sooner than giant caps in such environments.

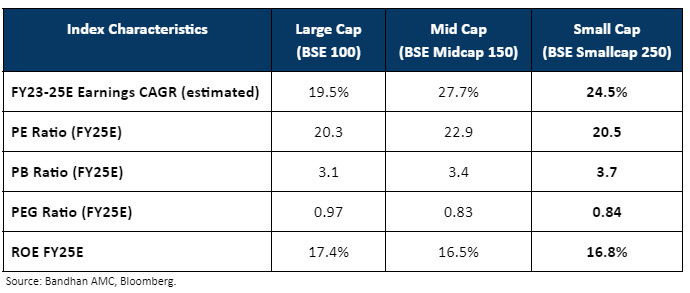

Small Caps normally carry out properly in a powerful earnings cycle section. Greater Valuations of Small Caps vs Massive Caps is pushed by Greater earnings progress expectations. BSE Small Cap 250 is estimated to develop at ~25% CAGR over FY23-FY25 (larger than BSE 100 which is predicted to develop at ~20% CAGR)

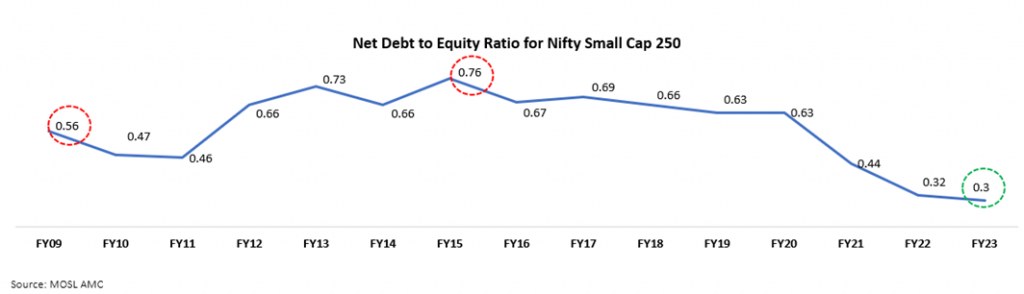

Robust Stability Sheets – Debt to Fairness ranges for Small caps at historic lows

Debt to Fairness ratio for small caps has diminished to 0.3x in FY23 from 0.8x in FY15 – the bottom within the final 15 years

Summing it up

-> 4 of our complete 6 indicators which we use to trace the small cap phase are flashing warning alerts:

- Damaging Indicators (Whole 4):

- Lengthy cycle exhibits that Small Caps are shut to historic peak ranges

- Valuations have grow to be ‘Costly’

- Sentiments are Euphoric – vital leap in small cap fund inflows (primarily from mutual funds) + few funds closing for contemporary inflows + Lot of New NFO launches

- Previous efficiency – contra indicator – very excessive previous returns warrants warning

- Constructive Indicators (Whole 2):

- Quick cycle – Traditionally, the Small Cap quick cycle from backside to peak lasted for ~1.5 to 2 years. The present small cap rally had began from Mar-2023. If we use earlier quick cycles as a tough information, the present rally could proceed until second half of FY25 (Oct-24 to Mar-25)

- Robust Fundamentals for Small Caps – Enhancing Profitability (ROE) + Greater Earnings Progress + Robust steadiness sheets (low debt)

- Set off to Monitor:

- SEBI’s actions to reasonable flows into small and midcaps

- Mutual Fund Stress Take a look at Outcomes

- Liquidity danger in small cap funds/PMS

View -> Time to be CAUTIOUS!

What does this imply in ENGLISH?

Small Caps are usually not in a bubble (learn as probabilities of a big 50-70% fall could be very low) – as

- Fundamentals stay sturdy – Strong earnings progress + Wholesome steadiness sheets

- Quick Worth Cycle Lens signifies additional legs to the rally

Nevertheless, the percentages of a short lived 20-30% correction has considerably elevated at this juncture as Lengthy Worth Cycle, Valuations, Flows & Sentiments, Previous Efficiency lens – all alerts are flashing RED.

What must you do?

- Rebalance your Small Cap publicity again to authentic allocation.

- If overexposed, scale back Small Cap publicity to <15- 20% of your Fairness portfolio (as per your danger profile)

- Proceed your SIPs provided that your time-frame is >7 years

- For Incremental Investments: Keep away from Massive Lumpsum Allocations

Different articles chances are you’ll like

Submit Views:

795