A reader asks:

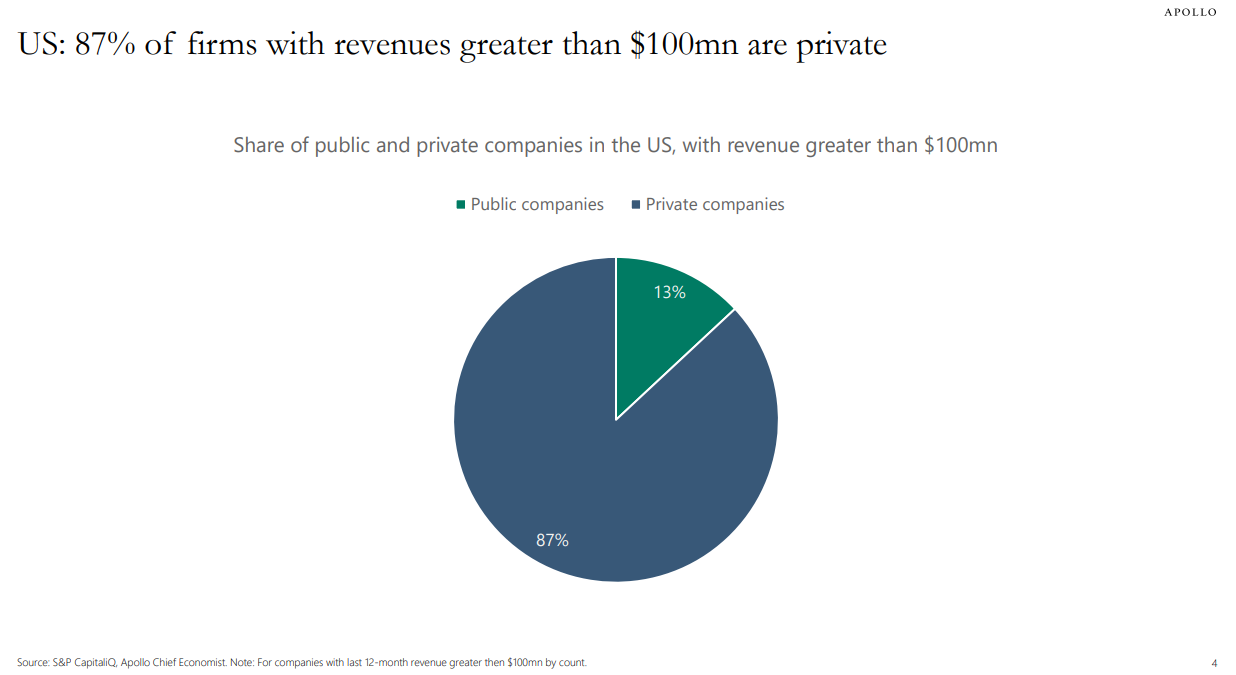

You guys have lately quoted Slock in two podcast episodes that Non-public Fairness Corporations, these with over 100 million {dollars} in income make up 87 p.c of that class versus solely 13 p.c of publicly traded firm fall into the 100 million in income class, and that quantity is barely rising.

With that stated, is that this ONE of the explanations inventory costs appear to repeatedly improve. As personal fairness firms proceed to extend in quantity, there are much less publicly traded firms subsequently there’s more cash chasing the ever reducing variety of public firms?

Right here’s that stat from Apollo’s Torsten Slok:

The Atlantic shared some knowledge concerning the dwindling variety of publicly traded shares together with the corresponding development in personal fairness investments:

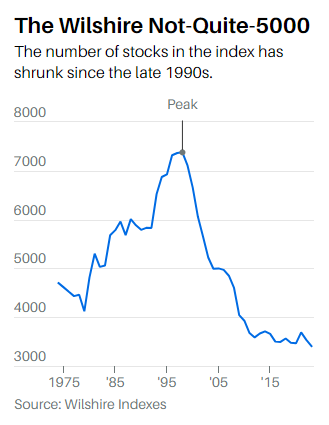

The publicly traded firm is disappearing. In 1996, about 8,000 corporations have been listed within the U.S. inventory market. Since then, the nationwide economic system has grown by almost $20 trillion. The inhabitants has elevated by 70 million individuals. And but, right this moment, the variety of American public firms stands at fewer than 4,000. How can that be?

One reply is that the private-equity business is devouring them.

In 2000, private-equity corporations managed about 4 p.c of complete U.S. company fairness. By 2021, that quantity was nearer to twenty p.c. In different phrases, personal fairness has been rising almost 5 instances sooner than the U.S. economic system as an entire.

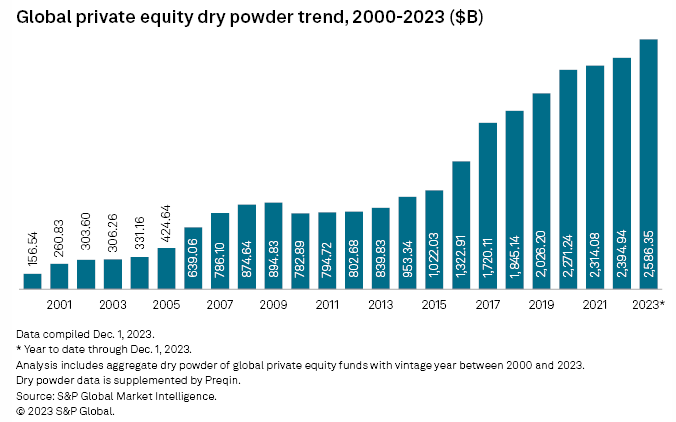

Non-public fairness managed lower than $1 billion within the mid-Nineteen Seventies. Immediately it’s greater than $4 trillion. There may be greater than $2.5 trillion in dry powder alone globally:

Non-public fairness is a giant a part of the U.S. and world economic system now.

Right here’s a have a look at the shrinking variety of public shares within the U.S. by way of Barron’s:

We’ve gone from greater than 7,000 shares within the mid-Nineties to extra like 3,500 now. The variety of public firms has been greater than halved.

The Wilshire 5000 is extra just like the Wilshire 3500. The Russell 3000 at present has solely 2,668 shares, whereas the Russell 2000 has simply 1,665 shares.

We’ve reached the purpose the place the indexes really feel like false promoting.

From a purely provide and demand perspective, it could make sense that extra {dollars} chasing fewer shares would drive up costs.

However there’s extra occurring right here. You even have to have a look at the varieties of firms which have gone away.

That spike in new firms in the course of the Nineties was one thing of an aberration of the dot-com bubble. It was principally tiny micro-cap firms.

Vanguard shared the information on this with Institutional Investor just a few years in the past:

Rowley says the proportion of large-cap, mid-cap, and small-cap firms that make up total market capitalization could be very constant going again to 1979. He says many analysts have made 1996, which had a file variety of public firms, a de facto anchor level. Nevertheless, the late Nineties markets have been at a excessive level, with many firms desirous to go public and money in on wealthy valuations.

“In the event you have a look at the overall pattern in historical past, there’s a rise within the variety of public firms main as much as 1996, and there’s been a lower down from that time,” says Rowley. “However once more, it’s nearly completely the area of micro-cap shares.”

In 1979, there have been 2,044 public micro-cap firms. In 1997, there have been 4,193, and in 2014 there have been 1,549. However they’re a small a part of the publicly traded universe. In 1979 and 1997, micro caps represented 3 p.c of the market. In 2014, micro-caps represented 2 p.c of the market. Micro-caps fell to 1 p.c by 2016.

Most of these micro-cap firms from the Nineties ended up going out of enterprise as a result of they’d no enterprise mannequin or fundamentals. They have been seeking to money in on the euphoria at a time when there wasn’t as a lot VC or PE cash sloshing round.

And micro-cap firms are a sliver of the U.S. inventory market from a market cap perspective.

Holding ten one-dollar payments doesn’t put you in a greater place than the individual holding a single one-hundred-dollar invoice.

Positive, there are some smaller firms buyers have missed out on due to extra enterprise capital cash, M&A and buyout exercise. However you would argue the remaining firms are actually even greater high quality due to this.

Michael Mauboussin wrote a paper concerning the shrinking variety of shares again in 2017 making this precise argument. This was the primary takeaway from that report:

Consequently, listed firms right this moment are on common bigger, older, and extra worthwhile than they have been 20 years in the past. Additional, they function in industries which are typically extra concentrated. The general measurement and maturity of listed firms means they’re extra more likely to pay out money to shareholders within the type of dividends and share buybacks than firms have been up to now.

We speculate that the maturation of listed firms has additionally contributed to informational effectivity within the inventory market. Gaining edge in older and effectively established companies is probably going harder than it’s in younger companies with unsure outlooks. In flip, the higher effectivity could also be one of many catalysts for the shift that buyers are making from lively to listed or rule-based methods.

It is smart this has created an setting the place it’s now tougher to outperform the market.

There are various causes the inventory market has been going up over time.

The variety of shares listed on the trade is just not one among them.

We mentioned this query on the newest version of Ask the Compound:

Barry Ritholtz joined me on the present this week to reply questions concerning the precise inflation fee, how fiduciary obligation works, worries about U.S. authorities debt and if we are going to see a flood of properties hit the market when child boomers start dying off.

Additional Studying:

The Rebirth of the IPO