One of many main amendments applied as per the Finance Invoice 2023 is to curtail LTCG (Lengthy Time period Capital Acquire) advantages by deeming the beneficial properties arising from ‘specified mutual funds’ as short-term capital beneficial properties (STCG).

What are these Specified Mutual Fund Schemes as per the Earnings Tax Act? What’s the main modification with respect to the taxation of the beneficial properties arising out a specified mutual fund for Monetary Yr 2023-24 (AY 2024-25)?

What are Specified Mutual Fund Schemes as per the Earnings Tax Act?

A mutual fund by no matter title referred to as, the place no more than 35% of its complete proceeds is invested within the fairness shares of home corporations. Examples are : Liquid Funds, Brief Length Debt Funds, Gold Mutual Funds, Fund of Funds and so on.,

For the needs of part 50AA of the Earnings Tax Act, “specified mutual fund” means a mutual fund by no matter title referred to as, the place no more than 35% of its complete proceeds is invested within the fairness shares of home corporations. Accordingly, an “equity-oriented fund” which invests in models of one other fund as an alternative of investing instantly in fairness shares of home firm could also be thought to be “specified mutual fund”. – AMFI

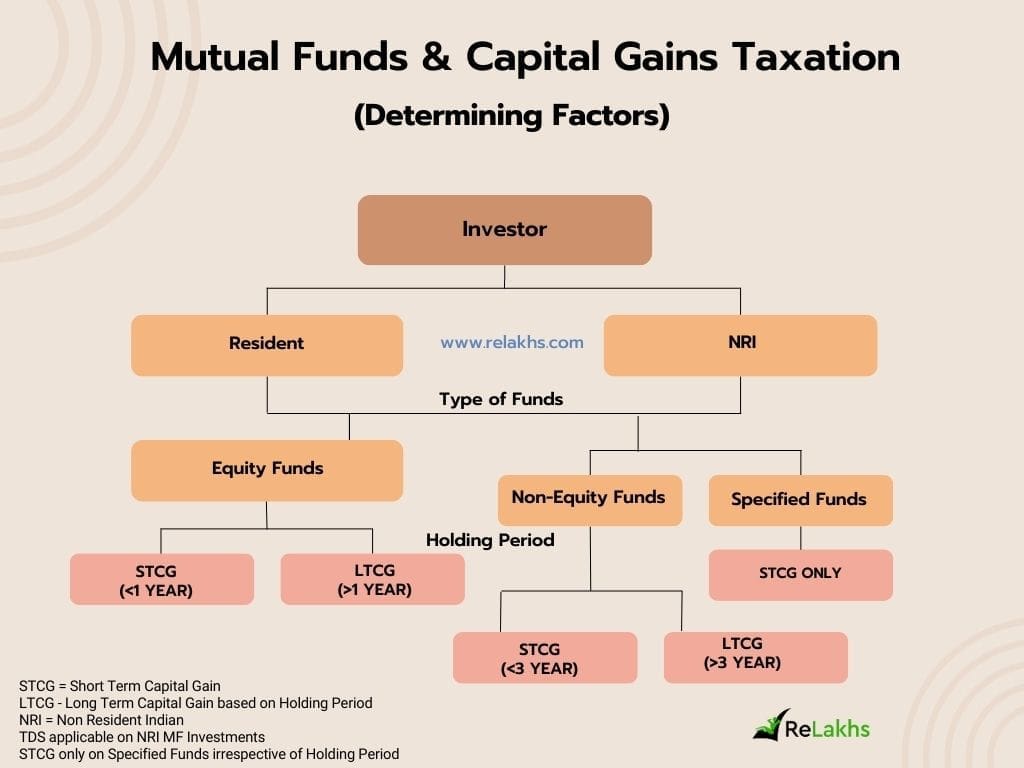

With this new modification, we now have three broad kind of funds – Fairness, Non-Fairness & Specified Funds.

| Share of Fairness Publicity | 0% to 35% | 36% to 64% | 65% & extra |

| Sort of Fund | Specified Fund | Non-Fairness oriented Fund (Hybrid Funds) |

Fairness Mutual Fund |

What’s the new Tax modification w.r.t Specified Mutual Funds?

Let’s first perceive how the capital beneficial properties of a mutual fund scheme are categorized as Brief-term or Lengthy-term?

Interval of Holding & Capital Positive aspects on Mutual Funds

Capital beneficial properties on Mutual funds may very well be both long run capital beneficial properties or short-term capital beneficial properties, relying in your funding horizon.

- Lengthy Time period Capital Positive aspects

- Should you make a acquire / revenue in your funding in a Fairness Mutual Fund scheme that you’ve got held for over 1 12 months, will probably be categorised as Lengthy-Time period Capital Acquire.

- Should you make a acquire / revenue in your funding in a Non-Fairness Mutual Fund scheme (or in a Debt Fund) that you’ve got held for over 3 years, will probably be categorised as Lengthy Time period Capital Acquire.

- Brief Time period Capital Positive aspects

- In case your holding in a Fairness mutual fund scheme is lower than 1 12 months i.e. should you withdraw your mutual fund models earlier than 1 12 months, after making a revenue, then the revenue might be thought of as Brief Time period Capital Acquire.

- Should you make a acquire / revenue in your Non-Fairness (or apart from fairness oriented schemes) that you’ve got held for lower than 36 months (3 years), will probably be handled as Brief Time period Capital Acquire.

The brand new modification that we’re discussing is expounded to non-equity oriented funds.

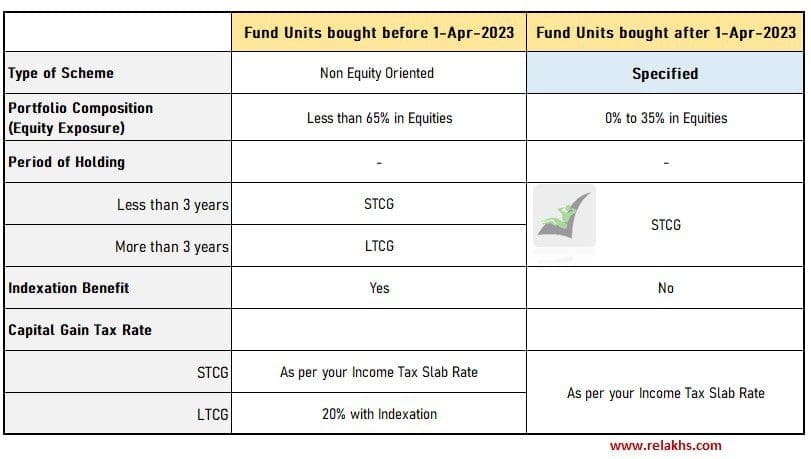

The Capital beneficial properties from switch or redemption of models of “specified mutual fund schemes” acquired on or after 1st April 2023 are handled as quick time period capital beneficial properties taxable at relevant earnings tax slab charges as supplied above irrespective of the interval of holding of such mutual fund models.

So, the indexation profit can be not accessible whereas calculating long-term capital beneficial properties on Specified Mutual Funds. Pursuant to the above change, advantages within the type of decrease tax charges and indexation accessible to LTCG on the sale of non-equity mutual funds might be changed by taxation on the most marginal fee, as relevant to STCG.

Nonetheless, because the beneficial properties are nonetheless characterised as capital beneficial properties, buyers are allowed to set off every other short-term capital losses which might be incurred by them in opposition to capital beneficial properties of specified mutual fund.

Associated Article : What’s Indexaton? How is it helpful?

When you have purchased models of a non-equity oriented fund previous to 1st April 2023 then this new tax rule is just not relevant.

Proceed studying:

(Put up printed on : 25-Sep-2023)